Participants will learn about Washington excise taxes, reporting classifications, deductions, tax incentives, sales tax collection and record-keeping requirements.

Read MoreVeterans can connect on social media to the IRS in order to stay in the loop regarding tax issues.

Read MoreWashington doesn’t have an income tax, but that doesn’t mean that businesses and business owners shouldn’t be thinking about potential state income tax issues.

Read MoreWhat is a local B&O tax? What’s different between sales taxes and B&O taxes? And how are these taxes applied?

Read MoreFor organizations that are quickly-growing, consistently introducing new products or services, and entering or navigating the world of e-commerce, up-to-date compliance software is a must-have when it comes to minimizing the risk of severe and expensive mistakes.

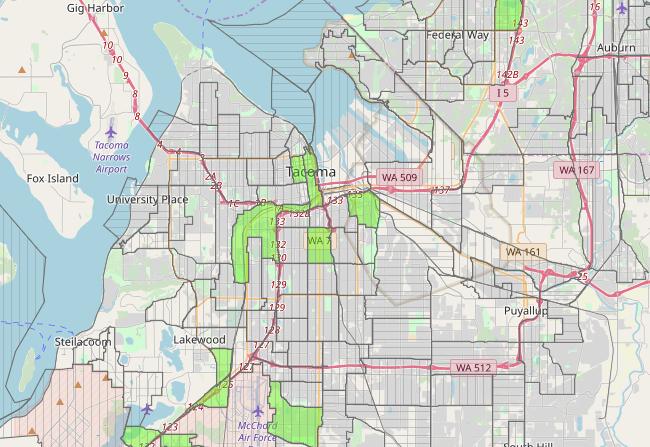

Read MoreThe IRS has issued guidance providing additional details about investment in qualified opportunity zones.

Read More