Business owners who actively participate in their business have historically been allowed a full deduction for any net business losses incurred during the year. However, the 2017 Tax Cuts and Jobs Act (TCJA) introduced new limitations that could catch some business owners by surprise come tax time.

Read MoreIn the week leading up to Halloween 2018, the firm dressed up for theme days in conjunction with a food drive for Nourish Pierce County.

Read MoreA new, 10 percent middle-income tax cut is conditionally expected to be advanced in 2019, according to the House’s top tax writer. This timeline, although already largely expected on Capitol Hill, departs sharply from President Donald Trump’s original prediction that the measure would surface by November.

Read MoreDo you know your business’s monthly break-even point? What is your client/ customer conversion rate? What is the utilization of your staff? How long does it take to bill and collect from clients/ customers? These questions highlight different Key Performance Indicators of which every business owner should be aware.

Read MoreThe Tax Cuts and Jobs Act (TCJA) made some changes to the deductibility of meals & entertainment expenses for the year beginning January 1, 2018. These changes caused some ambiguity over whether certain meals were 50% deductible or nondeductible.

Read MoreThe rehabilitation tax credit offers an incentive for owners to renovate and restore old or historic buildings. Tax reform legislation passed in December 2017 changed when the credit is claimed and provides a transition rule:

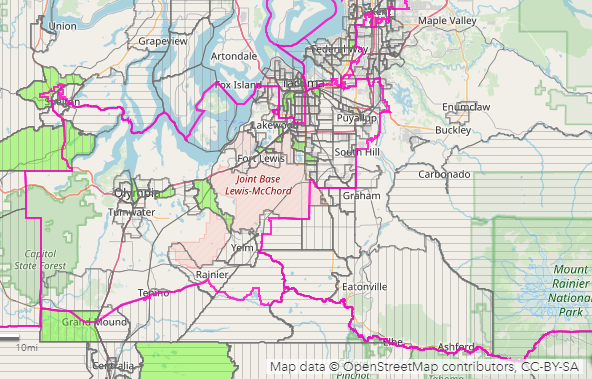

Read MoreA new tax provision contained in the 2017 Tax Cuts and Jobs Act (TCJA) provides a significant opportunity to defer the tax on capital gain from the sale of stock and other assets. Taxpayers who take the gain proceeds and invest them in certain economically distressed communities, known as Qualified Opportunity (QO) Zones, can qualify.

Read MoreRetirees should do a Paycheck Checkup to make sure they are paying enough tax during the year by using the Withholding Calculator, available on IRS.gov. The Tax Cuts and Jobs Act, enacted in December 2017, changed the way tax is calculated for most taxpayers, including retirees.

Read MoreSouth Sound Business magazine recently interviewed the firm and constructed a timeline in a ‘profile'-like feature in their September 2018 issue.

Read More